The A-Z Guide on How to Price a Product Like a Professional

Last updated: February 2nd, 2025

Pricing your products is one of the keystones that can set your business to success or on the contrary, set it on the wrong path that could lead up to failure. No surprise pricing is that powerful since it affects everything from your cash flow, and profit margins to expenses, and customers.

In this how-to-guide, I’ve gathered all the information you need to know about how to price your products properly. And even though there’s no magic formula for product pricing, it’s mandatory to know the strategies and then test and see what works for your business.

So if you’re planning to launch a new business or a product, make sure to analyze carefully and settle on a pricing product strategy and model that’s right for your business. And if you’re already in this competitive field, remind yourself of the good practices. In this article, we’ll mainly refer to product prices for both physical and digital products.

Let’s dig into the highs and lows of pricing a product.

What is product pricing?

Product pricing is the price you charge your customers for the product you sell, which has a direct impact on the success of your business. It’s imperative that you know the costs of running your business right from the start. One basic rule that you can begin with is to make sure that your price will cover all the costs, otherwise, your cash flow will get to be negative. Not only that but you also risk losing your financial resources and ultimately getting out of business.

To make it easier, get a piece of paper and a pen. Now begin to write down your business costs such as property payment, equipment, salaries, utilities, financing costs, etc. – basically everything your business costs will need to cover. But don’t forget to also add your profit when calculating costs.

As you can see, product pricing requires lots of analysis, time, and market research. It’s not about setting a price and hoping for the best. That’s not a healthy nor professional pricing strategy. You have to really investigate and dig for deeper data, results, and stats in order to set a proper price for your products. Using residential proxies can help gather accurate competitor pricing data across different regions without triggering blocks or misleading geolocation filters.

You have to be mindful of the price you set so it will help your business gain profit, which will cover your expenses and will satisfy your customers.

OK, but where to start? This brings me to my next point.

Essential metrics for your product pricing strategy

Because product pricing is not a decision you only take once, it’s crucial to know what are the certain variables and essential metrics that should always be on top of your mind when reevaluating your pricing strategy.

Always include these metrics in your product pricing strategy:

- Fixed costs

- Variable costs

- Consumer surplus

- Market demand

- Cost of goods sold – COGS

Let’s take each of them one by one and get into more details.

1. Fixed costs

The fixed costs are usually expenses that happen from month to month such as salaries, rent, utilities, and so on. Even though salaries may rise, or the rent let’s say will go up, you need to make sure that your products’ price will cover the recurring expenses.

2. Variable costs

Unlike fixed costs, the variable costs change in proportion to the company’s production and sales volume. They rise when the production increases, and fall when the production decreases. No matter the case, assure that your variable costs are covered completely as well.

3. Consumer surplus

Consumer surplus is the difference between the price consumers pay for a good or service and the price they would be willing to actually pay. Most times, consumers pay less money than they’re actually willing to pay. So take notice when calculating the prices and ensure they step up to consumers’ willingness to pay.

4. Market demand

When calculating your product pricing always take into account the market trends. It’s important that your product pricing reflects the market demand so you don’t end up with prices that are neither above nor beyond, but right there on the spot.

5. Cost of goods sold – COGS

COGS represents the total amount your company paid as a cost directly related to the sale of products. COGS basically checks how much you are spending on inventory, and it usually includes costs such as raw materials, packaging, or anything related to producing or selling the goods. This can also include other expenses, such as the cost of developing an app for distribution, or the costs associated with marketing.

How to price a product correctly is not an easy job, but it definitely involves lots of research and data. So ensure to always have these metrics in mind when calculating your product pricing.

And now let’s get further down into how to price a product like a pro.

How to price your products in 5 steps

- Know your customers

- Have a deep understanding of your costs

- Set a revenue target

- Keep an eye on your competitors

- Evaluate the market evolution

Let’s take each of these ones by one and get into more details.

1. Know your customers

We can never talk about product pricing strategy without starting with the customers in mind. So the essential step you don’t want to neglect is making sure you know your audience. By doing thorough market research, you can get a very granular understanding of your market segment and potential customers.

Just assure yourself you get the right data and information about them such as demographics, what are their approach to prices, what they buy, and how much they’re willing to pay for a product.

Here’s a list of topics to cover in order to know your customers better:

- Demographics: Find out the gender, age, location, and income level

- Competitive knowledge: What are their favorite products similar to yours

- Budget preferences: How important is the price of an item for them

- Motivation: What is more important: price or quality

- Status: How important is the product’s brand name

- Psychological susceptibility: Do they usually buy products with prices such as 7.79 euros

I know this may imply working with a specialized team of marketing professionals and maybe investing some money. But believe me, it’s going to be worth it. Knowing your audience is one of the key elements in pricing your products accordingly.

2. Have a deep understanding of your costs

Another important aspect when it comes to how to price a product is to gain a deep understanding of your costs so your business gets profit. One thing you should have in mind is that the cost of a product is more than the literal cost of the item. Every price includes overhead costs such as fixed costs and variable costs. For instance, a fixed cost can be the rent or salaries, and variable costs delivery costs or packaging supplies.

You definitely have to include these costs in your product’s price estimation, and therefore obtain the real cost of your product.

Don’t fall into the trap of not factoring in these costs because you risk underpricing your product, or on the contrary, you may overcharge it. That’s why it is crucial to keep track of all these cost details so you can have a clear overview of what our product price should be.

If you find it difficult, open a spreadsheet and list all the costs you need to cover from month to month. Add the money amount for each cost and the total result should help you set the revenues you need to generate in order to cover all your costs.

3. Set a revenue target

The following step is to set a revenue target that you want your business to accomplish. You can start by estimating the number of units of the product you want to sell in the upcoming months or years. Then simply divide the revenue target by the number of units you expect to sell. By doing this you’ll get your product’s price in order to achieve your revenue target and goals.

But if you have a lot of different products, then you’ll need to set your overall revenue target for each individual product. And then continue with the same calculation to figure out the price for each product. Achieve your financial goals by always setting a revenue target that you want to achieve.

4. Keep an eye on your competitors

I know this may not come as a surprise to you, but it’s one essential thing to do when you want to know how to price your product. And not only you will be taking a look at your competitors, but your customers as well. So do a comparative analysis between your competitors’ prices and your product’s price. Do you offer something extra that would justify your higher price? Or are you sure your product is known as a high-quality product and you can charge for more than your competition?

If you can reply with a convincing “Yes” to these questions, then you’re right. You may be able to support a higher price. Be cautious about the regional differences and also compare the net prices. It may be a good idea to carefully analyze how your company’s products and your competitors’ products are perceived by the market. Evaluate every tiny detail honestly and set your product’s pricing accordingly.

5. Evaluate the market evolution

The last step you need to take into account is to evaluate the outside factors that may impact the market evolution. For example, if a new competitor is on the rise you might find your business in a price war soon enough. Besides that, there are new laws coming up, the economy may experience either inflation or recession. So be consistently in the loop to know what is going on in your market field.

So let’s do a little recap with everything that we find out now:

- Knowing your customers will get you a clear overview

- You need to find out what the market is willing to pay

- Always keep an eye on how much your competitors charge

- Make sure you know how your product is perceived in the market

As I previously mentioned, there’s no magic formula when it comes to product pricing. You only need to do your research and analyze insightful data so you can properly price your products.

Here’s also a video on how to find the ideal price for a product. Make sure to check it out.

Now let’s take a look at some of the most known and practiced strategies for pricing products.

The different strategies for product pricing

Even though there are many types of pricing strategies such as geographic pricing, psychological pricing, premium pricing, penetration pricing, skimming pricing, bundle pricing, project pricing, and others, I’ll only tell you about the most known and used ones.

So let’s begin with the first one.

1. Value-based pricing

The value-based pricing strategy is when companies decide to price the products based on how much the customer is willing to pay. So even though they could charge more for their products, companies that use the value-based pricing strategy will set their prices based only on customers’ interests and data.

You might say that this will be greatly appreciated by customers and may even increase their loyalty. Yes, I agree with you. But on the other hand, value-based pricing implies constantly knowing your customers’ profiles and buyer personas. And you may find yourself varying your prices too often based on those differences.

If you’ll settle only for one pricing strategy from the ones I tell you about, then it’s important to know the pros and cons of each pricing strategy.

2. Competitor-based pricing

This pricing strategy focuses on the competitors’ prices as the starting point. So it doesn’t take into account the consumer demand or the quality of the product. Companies that use this strategy usually price their products slightly above, below, or the same as the competition. The main purpose of this strategy is to increase the consumers’ decision factor in order to choose your product over the competitor’s.

Another great advantage of the competitor-based pricing strategy is that it may put your brand in a better position in the market. And it’s very beneficial especially if your brand offers things that your competitors don’t. It may be access to some loyalty benefits, some birthday gifts, great customer service, an awesome return policy, etc.

But let’s not forget that consumers look for the best value of a product and sometimes this one isn’t always at the lowest price. So keep that in mind when pricing your products using the competitive pricing strategy.

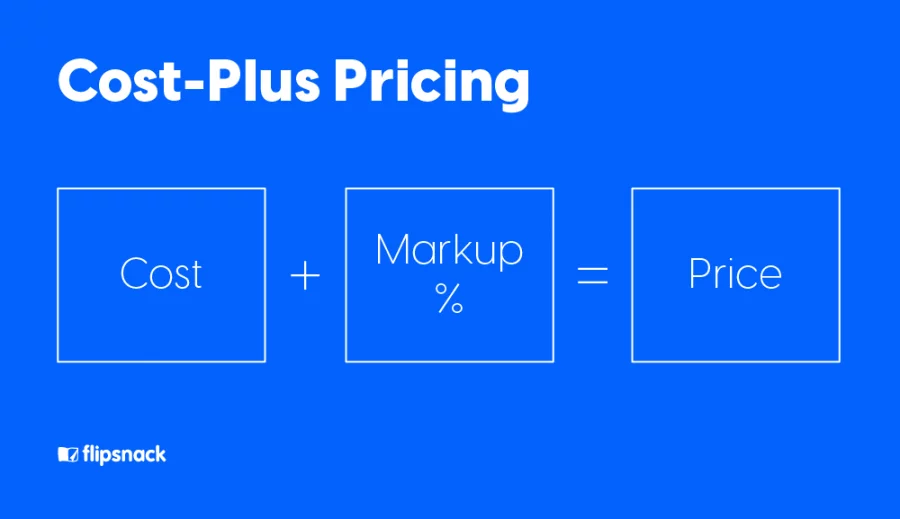

3. Cost-plus pricing

The cost-plus pricing strategy is when brands price their products based on the cost of producing their products/services. This strategy is also known as the markup strategy as brands will markup their products based on how much profit they’d like to make. For this method, you only need to add a fixed percentage to your product’s production cost.

Let’s say you sell bags. The bags cost 25 euros to make, and you want to gain 25 euros profit on each sale. In order to achieve that, you should set the bag’s price to 50 euros, which is a markup of 100%.

One thing to have in mind though is that this strategy may not work for companies that offer a service. Usually, their tools imply more value than the cost to create them so it wouldn’t be reasonable to use the cost-plus strategy.

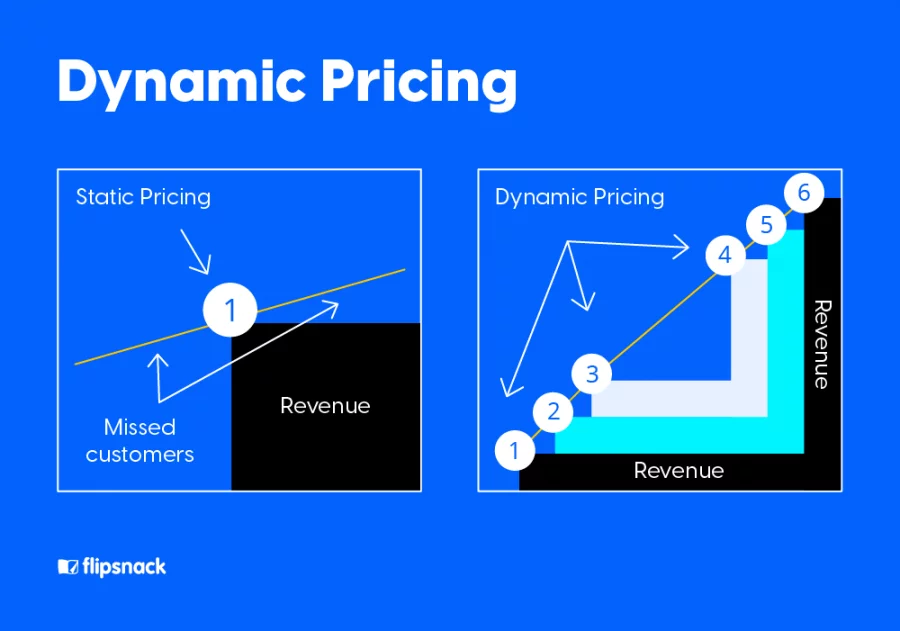

4. Dynamic pricing

This dynamic pricing strategy it’s a flexible one as the prices fluctuate based on the consumer demand and on the market. The dynamic term represents this strategy precisely as you can already figure that prices on the market can change quickly and in a short period of time. This may benefit a lot of companies that usually offer last-minute offers, promotions such as hotels, airlines, or even event venues.

What’s also great about this pricing strategy is that it allows companies to shift prices, plan ahead different kinds of promotion prices and then test to see their performance.

Now that we’ve covered some of the most used product pricing strategies, I encourage you to choose the one that suits your needs best. And why not, even experience each one of these just to test it out. Make sure to consult with your marketing and sales team and analyze every detail carefully.

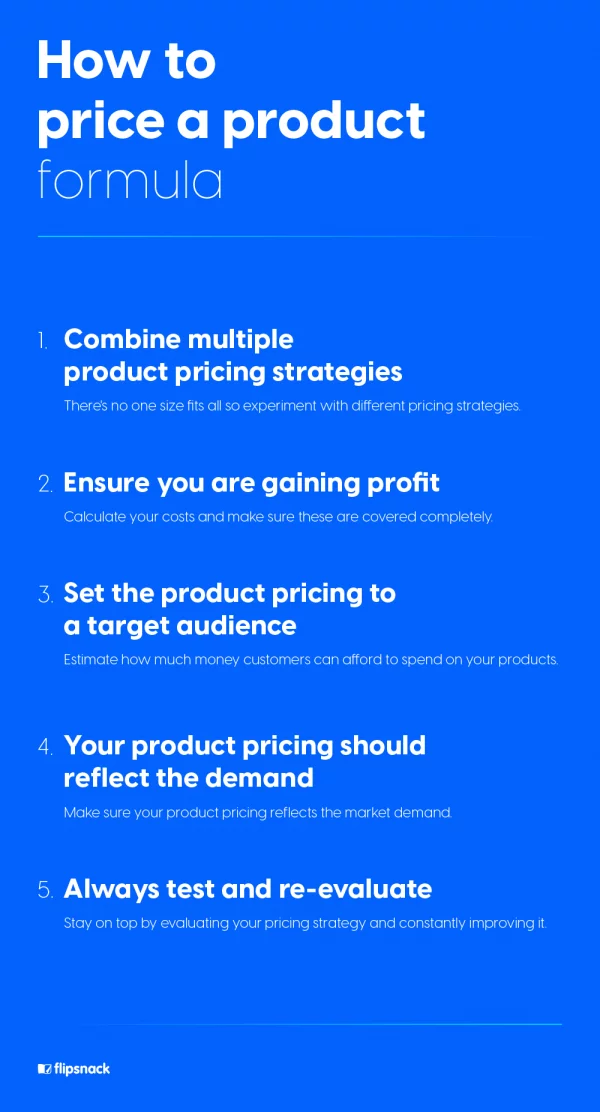

And here’s an image that you should definitely pin to your Pinterest board and have a look at whenever deciding on how to price your product.

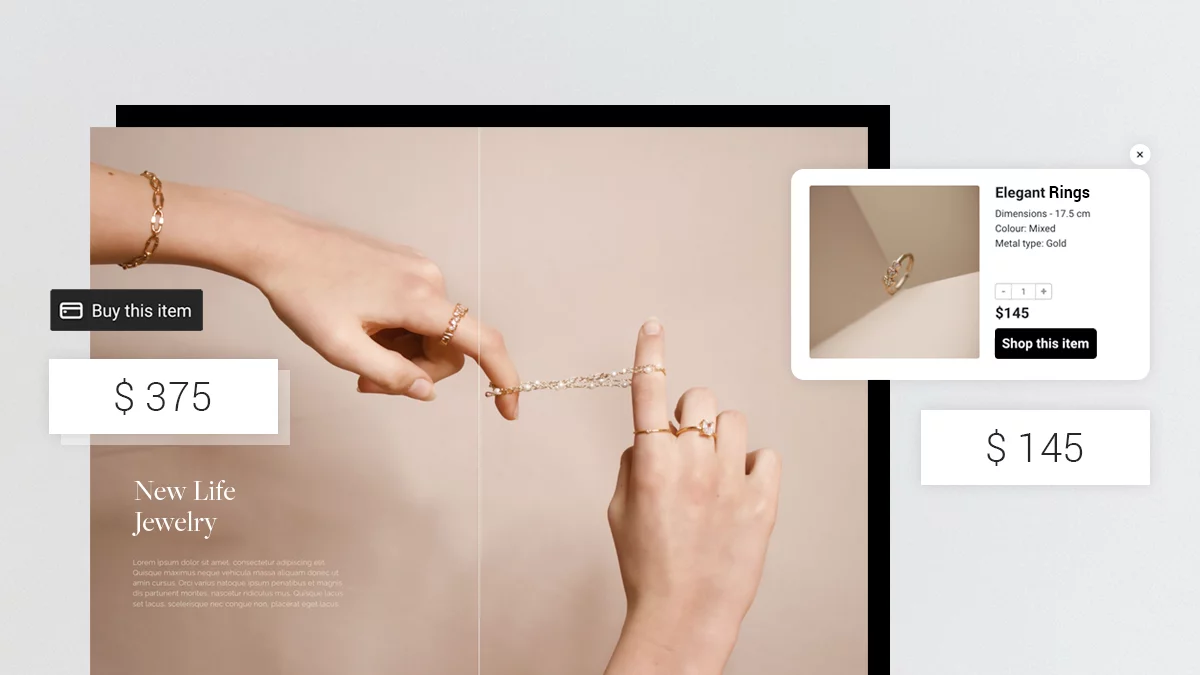

Showcase your products in an enticing way and sell more

Let’s be honest, after all the pricing strategy is set and decided, your business’s ultimate goal is to sell more. And how can you do that? Not only by choosing a proper pricing strategy but by using all the digital marketing tools you have at your disposal.

From a professional website to social media channels and all the marketing materials available under the sun. Let me introduce you to one of the most loved marketing materials by retailers and wholesalers – digital catalogs.

Why are these so important? Digital catalogs can be your next online store where you showcase all your products. You can include products’ prices, descriptions, images, and every other aspect you’d think of. And the best part? Sell your products by including amazing shopping features to make the entire experience a smooth one.

Start by converting your PDF into a digital catalog in a trusty app, such as Flipsnack. Then design it to make it interactive and engaging for your customers. By using digital marketing materials in your selling strategy, you increase your chances of selling more in a fun way.

To be more specific, take a look below at this product catalog template. You have photos, descriptions, videos, shopping buttons, etc. Basically, all the tools you need are at your fingertips to create an impressive digital experience.

So after you and your team choose a smart pricing strategy for your products, move on to the next step. Impress clients and be on top of the competition by using every tool you can in order to sell your products to a larger audience. Reach more – sell more! It’s that easy!

Use a product pricing calculator

If you’ve reached this point, you might feel a little overwhelmed. As you’ve seen, product pricing involves lots of steps, options, and a dozen of variables to consider. But let’s skip to the good part! In order to succeed in your product pricing strategy, you can use different kinds of professional calculators to be done with this process a lot faster.

So I did the legwork for you and I put together a list with some professional product pricing calculator tools that you need to try.

Product pricing calculator tools:

- Shopify

- ProfitWell

- PriceEdge

Shopify

By using Shopify’s product pricing calculator you can find a profitable selling price for your products. The calculator uses the cost-plus pricing strategy that we’ve talked about earlier, so it takes the total costs of your product and then adds a percentage markup to determine your final selling price. Check their website for more information about this.

ProfitWell

ProfitWell uses industry software to combine pricing data in order to accelerate companies’ growth and it’s called Price Intelligently. Their calculator takes several factors into accounts such as price localization, buyer personas, competitive monitoring, and more. Again, make sure to check out all the details about their price calculator strategy on their website.

PriceEdge

With PriceEdge it’s easy to optimize your prices and automatically calculate and get new prices. It uses highly flexible cloud-based software to create, manage and rearrange any pricing strategy. From competitor price tracking to AI-driven price optimizations, to price management, to price analytics, PriceEdge offers you basically everything you need to achieve a knock-off product pricing strategy.

Of course, there are many more that you can test out, but you can start from here since these tools are known to be great. So I encourage you to start your product pricing calculator journey with a tool that works for your business and I only wish you an avalanche of sales to come!

Product pricings FAQs

Think of the following metrics: total fixed costs, variable costs and semi-variable costs, target audience, market trends, and competitors’ prices.

Price elasticity of demand reflects how a change in price can affect consumer demand. A product is considered inelastic if consumers still buy it despite the price increase. On the other hand, a product is considered elastic if the product suffers from pricing fluctuations. Make your product inelastic so the demand will remain stable even when pricing fluctuates.

The average gross profit margin for retail is around 53%. Try to keep your profit margins around this number.

Most companies start by using a product pricing calculator. You can also do it by yourself if you add up your variable costs and fixed costs. Then you only need to apply a profit margin in order to get a target market price.

Always keep evolving your product pricing strategy

I know product pricing is not a piece of cake, but hang in there my friend. The great news is that you can collaborate with your team, decide on the product price together and even learn from mistakes. Again, the magic product pricing strategy doesn’t exist. But knowledge and being consistent with learning how to properly set prices is a job that you can do. So get concrete data and based on that, set accurate prices that will keep your customers coming and your profit growing.