Enhance insurance broker-HR dynamics with digital tools

Last updated: January 9th, 2024

The HR-broker relationship landscape can be tough to navigate. It’s no secret that insurance brokers, agents, and consultants play a critical role in shaping employee benefits. Gone are the days when their job was just to present options and sign up companies for standard packages. Now, they’re right in the thick of it with HR departments, helping to tailor benefits that not only fit diverse employee needs but also keep companies on the cutting edge of competitiveness and worker satisfaction.

But here’s the thing: while the need for personalized benefits packages is growing, so is the complexity of managing them. That’s where digital tools come into play. Take Flipsnack, for example. It’s not just about converting static PDFs into something prettier like flipbooks. It’s about transforming how employee benefit brokers and HR teams work together to create, update, and distribute benefits information that’s not only comprehensive but also super easy to digest.

Using digital tools means saying goodbye to back-and-forth emails with huge attachments. Instead, welcome real-time updates, interactive content, and the ability to track what employees actually care about in their benefits. This isn’t just about keeping up with technology – it’s about making real, meaningful enhancements in how brokers and HR departments serve the workforce.

A benefits broker serves as a strategic partner to HR teams, helping them design, implement, and manage employee benefits packages. They provide expert guidance on cost-effective solutions, navigate compliance requirements, and stay updated on market trends. Beyond open enrollment, brokers offer ongoing support, employee education, and tools to simplify benefits administration, ensuring HR teams can meet workforce needs effectively and efficiently.

Table of contents

Broker HR management – why is it important?

When it comes to managing employee benefits, insurance brokers are not just facilitators; they are essential partners to HR teams. Brokers can be lifesavers, helping to smooth out processes. This ring true especially during hectic periods like open enrollment, that otherwise might be overwhelming. Good management builds relationships and trustworthiness, which is one of the stepping stones for a healthy business.

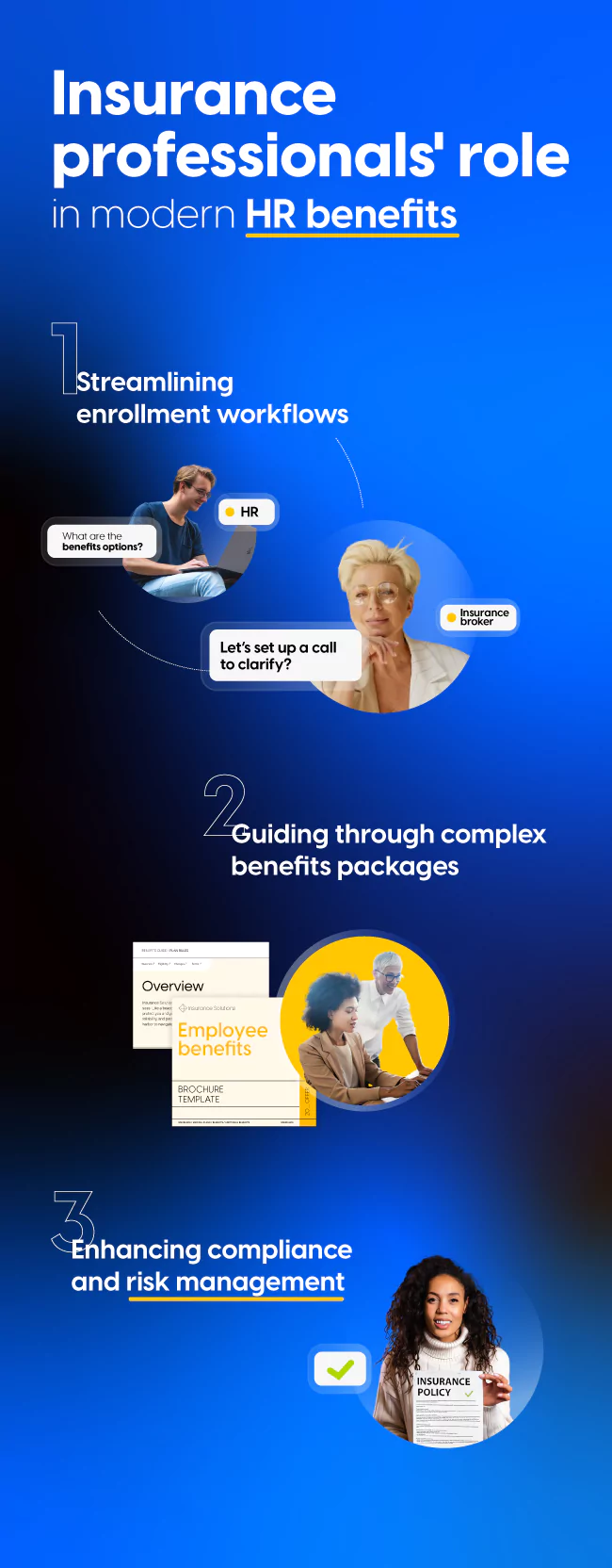

Streamlining enrollment workflows

One of the best practices for HR management can be discovered in the open enrollment period. It is one of those critical times that can make or break the perceived value of HR in an organization. It’s all hands on deck, and the pressure is on to ensure every employee feels informed and confident about their benefits choices. From the insurance broker’s perspective, this is where they step in with their expertise to streamline this chaos. They handle the heavy lifting—organizing information sessions, clarifying benefits options, and ensuring that all paperwork is shipshape. This not only saves time but also drastically reduces the stress on HR teams. It allows them to focus on strategy and employee engagement rather than drowning in administrative details.

Guiding through complex benefits packages

Beyond just managing the rush of open enrollment, insurance brokers play a crucial role in shaping the benefits themselves. They have a unique position at the intersection of market knowledge and organizational needs. This position allows them to tailor benefits packages that hit the mark perfectly in terms of coverage and cost-effectiveness. Their deep understanding of various insurance products and regulatory landscapes helps HR navigate the complexities of benefits packages. The same packages that support the health and financial well-being of employees across the board.

Enhancing compliance and risk management

Insurance brokers bring invaluable expertise in understanding and adhering to the ever-changing laws of healthcare and employment. They ensure that benefits packages not only meet current legal standards but are also prepared for upcoming changes, protecting the company from potential fines and legal challenges.

The insurance consultants should also help mitigate risks by analyzing the specific needs and potential vulnerabilities of a company. They can recommend coverage options that mitigate risks associated with employee health and safety, financial liabilities, and other critical areas. Their insights help HR teams design benefits programs that safeguard the organization and its employees effectively.

In a nutshell, the collaboration between insurance professionals and HR can transform the benefits administration from a logistical nightmare; into a strategic asset that enhances employee satisfaction and retention. Using digital tools like Flipsnack further empowers this partnership, enabling seamless updates, clear communication, and engaging delivery of benefits information that truly makes a difference.

Common challenges in HR-Broker collaboration

1. Misaligned communication objectives

One of the primary challenges in HR-broker relationships stems from unclear or misaligned communication goals. HR teams often focus on streamlining employee benefits delivery, while brokers emphasize compliance, cost savings, or market trends. This disconnect can result in missed opportunities to provide tailored benefits solutions that truly meet employee needs.

2. Limited understanding of HR priorities

Brokers may not always fully understand the operational constraints HR professionals face, such as limited resources, time pressures during open enrollment, or managing employee engagement. This gap often leads to solutions that are technically robust but fail to resonate with HR’s immediate needs or internal communication strategies.

3. Inefficient information flow

The lack of a centralized or efficient system for sharing benefits information and updates creates bottlenecks. HR departments may struggle with outdated tools or manual processes, while brokers lack real-time insights into organizational priorities, making it difficult to align their recommendations with current HR challenges.

4. Inadequate support during open enrollment

Open enrollment periods amplify these challenges. HR teams often cite insufficient support from brokers during these critical times. Whether it’s lack of timely materials, insufficient training, or a failure to address unique company needs, these issues erode trust in the broker relationship.

5. Failure to foster a collaborative partnership

Many brokers and HR teams operate in silos rather than as collaborative partners. Without regular touchpoints or mutual feedback loops, the relationship stagnates, leading to generic, cookie-cutter benefits packages that don’t reflect the evolving needs of employees or the business.

6. Navigating complex benefit structures

The ever-evolving landscape of employee benefits, compliance regulations, and competitive offerings creates confusion for HR teams. Brokers often assume HR professionals have the bandwidth and expertise to decipher complex policies, which is not always the case.

Using technology for better HR-Broker partnerships

Professionals in the insurance sector need innovative tools and strategies that promote transparency, real-time collaboration, and shared insights. Solutions like digital communication platforms or regular strategy workshops can bridge these gaps, helping brokers and HR teams better align on objectives and optimize benefits delivery.

In the complex landscape of employee benefits, traditional communication methods like static PDFs or Word documents often fall short. They lack the dynamic capabilities needed to engage today’s workforce effectively. Enter platforms like Flipsnack, which are transforming how insurance brokers and HR teams manage and communicate benefits.

Reviving benefits communication with Flipsnack

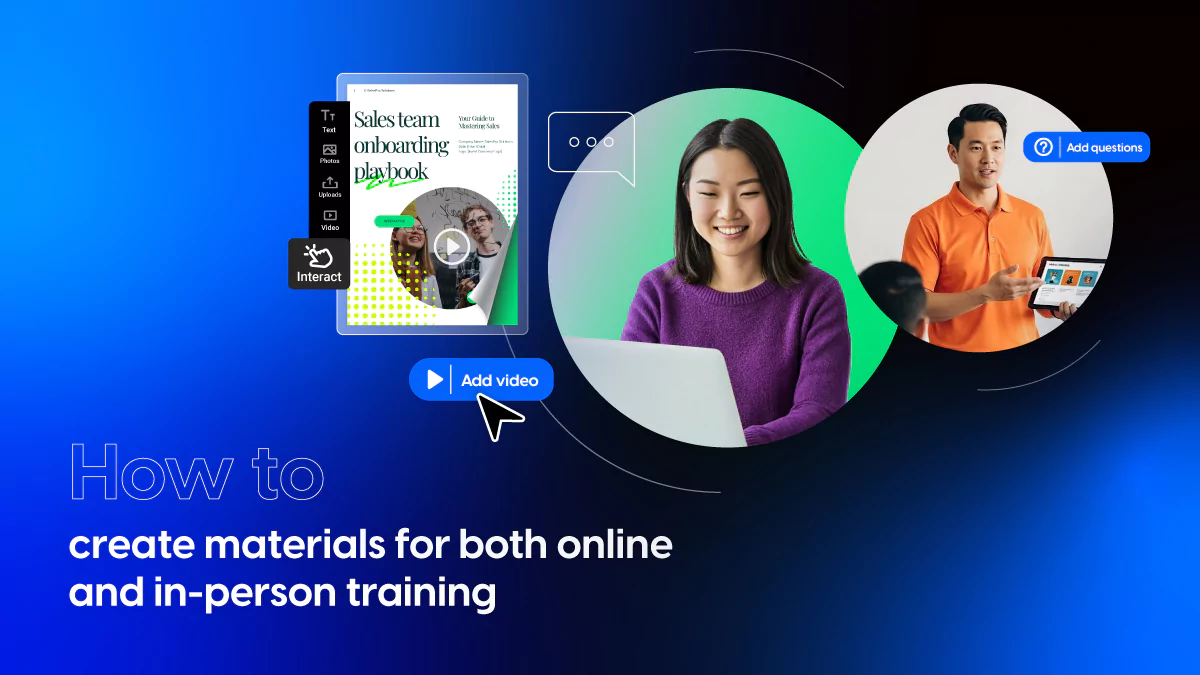

Flipsnack steps up as a powerful tool by turning static PDFs into interactive digital flipbook guides. This isn’t just about making documents look better—it’s about making them work better. With Flipsnack, insurance teams can create engaging employee benefit booklets, guides, or flyers that are not only visually appealing; but also interactive. This means embedding links, videos, and other multimedia elements right into the document, which can explain complex information in a way that’s easier to understand and much more engaging.

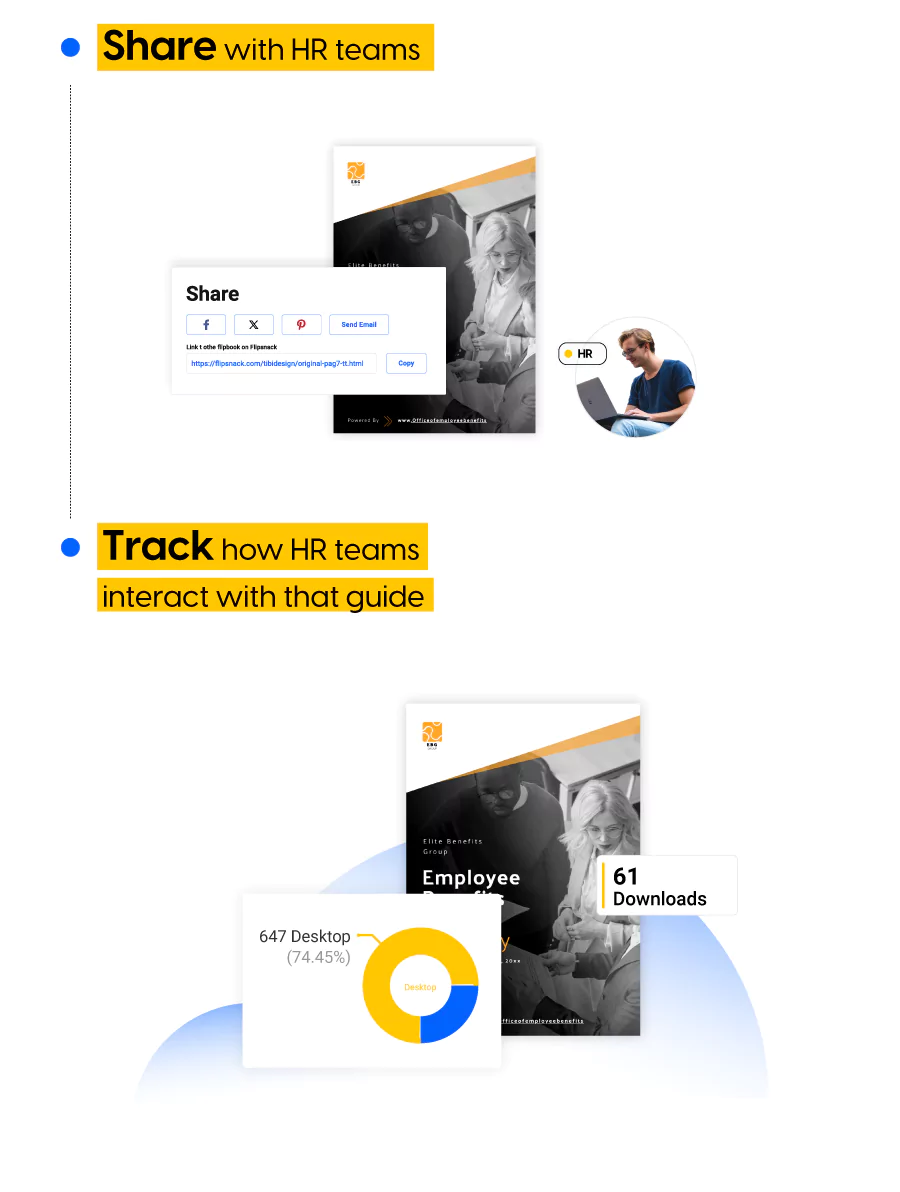

Real-time updates and secure sharing

One of the standout features of Flipsnack is its capability for real-time updates. In the fast-paced world of insurance and benefits, being able to update a document and keep the same share link is invaluable. This means that everyone has the latest information without the hassle of redistributing new versions of updated documents. Additionally, it offers extensive privacy options, which allow teams to control who sees the document and how it’s distributed. Documents can be shared privately with clients, enhancing confidentiality and ensuring that sensitive information remains protected.

A better way to collaborate and track

Insurance teams can work together in the same space, regardless of their physical location, which streamlines the creation and revision of benefit documents. Once these documents are shared online, Flipsnack’s tracking capabilities come into play. Teams can see detailed statistics on how their materials are being viewed and used. It allows them to adjust their strategies and communications based on real user engagement data.

By using a platform like Flipsnack, insurance brokers and HR departments can not only improve how they create and share information; but also gain insights that help them better understand employee needs and reactions to benefits offerings. This leads to more informed decision-making and ultimately, a more satisfied and well-informed workforce.

Trends and impact of technology on HR and broker collaboration

Technology is transforming HR and broker collaboration, driving efficiency and enhancing outcomes. According to Gartner, AI and machine learning will be standard features in HR technology by 2025, automating tasks like data entry and benefits analysis. This frees HR and brokers to focus on strategic initiatives such as employee engagement and personalized benefits planning. Advanced analytics tools provide deeper insights into benefits utilization and employee preferences, while machine learning courses help HR teams interpret this data more effectively, enabling cost-effective, tailored packages that boost satisfaction and retention. Deloitte highlights blockchain as a key technology for securing sensitive HR and benefits data, ensuring tamper-proof, transparent information sharing and fostering trust.

These advancements reshape collaboration by enabling seamless platform integration, such as Flipsnack with HR management systems, ensuring real-time updates and reducing errors. Mobile and remote technologies support distributed workforces by offering instant access to benefits information and real-time collaboration. Additionally, big data enables personalized benefits offerings and targeted communication, improving relevance and engagement. Together, these tools create a more interconnected and efficient benefits management landscape, setting the stage for future innovation.

Embracing digital tools in the broker-HR collaboration

As we’ve explored throughout this article, the integration of digital tools like Flipsnack is revolutionizing the way insurance professionals and HR departments collaborate. The benefits of adopting such technologies are clear: enhanced efficiency in benefits administration, more effective communication. And an overall improvement in employee engagement.

Digital tools are not just about upgrading technology; they’re about transforming interactions and processes to be more responsive and tailored to today’s workforce needs. They enable real-time updates, secure information sharing, and interactive content that can make understanding complex benefits packages easier for everyone involved.

For insurance professionals, now is the time to step forward and advocate for the adoption of these digital solutions. By doing so, you not only streamline your own processes but also greatly enhance the service you provide to HR departments. Ultimately, the employees who indirectly depend on you for their benefits needs will also be positively impacted.

Let’s not wait for the future to dictate our actions. Instead, take the initiative to adopt and promote digital solutions in benefits administration today. Embrace the tools that will define tomorrow’s industry standards, improve your operational efficiency, and elevate the employee experience. Start your journey with platforms like Flipsnack; and discover how advanced collaboration can lead to more successful outcomes for everyone involved.